The coming horizon of digital healthcare

The Good Times are Over?

I immigrated to the U.S when we were barely months into the Great Recession and did not personally experience the contraction of an economic downturn. While the recovery took much longer than people thought it would, I never directly felt the $4+/gallon oil prices, the empty malls, the 10% unemployment rate, and of course, the toll it took on the population's health.

Fast forward to the first half of 2022, the current direction of the markets is helping me to comprehend the whole story. As our generation has become the primary workforce of the 21ST century, we must ask ourselves about what has changed. Is this time different?

There have been four major inflation events in the past centuries. From Post WWII to the oil shocks of the 70s, numerous factors contributed to the spur of inflation, ultimately creating a gap between the supply and demand of goods. Today, we have a $2Tn+ stimulus package coupled with a decade-long easing of monetary policy that has resulted in significant demand for goods. On the supply side, with the war in Ukraine and China’s zero-covid policy, there is a substantial shortage in manufacturing and natural resource supplies.

Since the peak in November of 2021, there has been a series of market dips reflecting the aforementioned factors. It once again reminds investors of the importance of business fundamentals. While an increased bear sentiment strikes across the board, every public company’s stock performance is impacted in different magnitudes due to a combination of the elastic nature of their products, existing supply and demand situation, business models, customer types, and many more.

A few sectors, such as consumer staples, utilities, and healthcare, are more recession-proof than others. For example, household spending on healthcare grew consistently during the recession (+4.3%), and the entire healthcare sector witnessed a much lower unemployment rate compared to others.

The current state of digital health business models

Where does digital health fit into the trend?

As digital healthcare investors, we believe in the core value of enabling citizens to have access to high-quality care and investing in digital solutions to address the evolving problems that directly or indirectly hold us back.

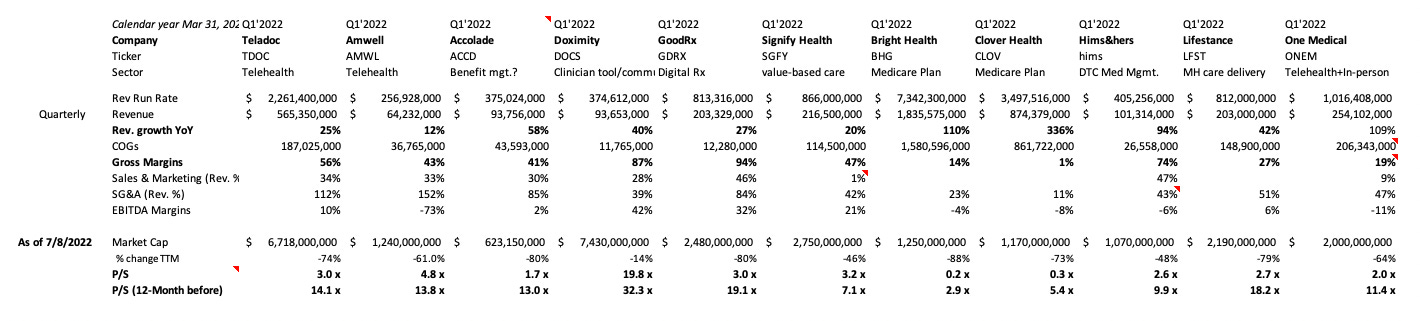

Unlike established industries, we see digital health as having unique characteristics that impact company performance in multiple dimensions. And the companies perform in different ways based on their business model and the end customers they serve, e.g., insurance products (NYSE: BHG), hospital systems, healthcare workers (NYSE: DOCS), pharma/medical device companies (NASDAQ: PEAR), etc. One can be a B2B SaaS-like (NASDAQ: GDRX), while another can be a DTC-managed marketplace (NYSE: HIMS).

These business models and product types also define a company’s exit pathway as the industry becomes more mature. A company with a flagship RPM (remote patient monitoring) product would likely fit into the medical device product category and attract acquisition interests from corporates betting heavily in that ecosystem such as Phillips and ResMed. On the other hand, Flatiron’s $1.9Bn acquisition by Roche in 2018 showed pharma’s appetite for physician access via new technology platforms.

Why does it matter? Companies are generally valued based on comps analysis and discounted cash flow. Analysts prefer to use other companies of similar nature to determine one’s comp multiples with adjustments for the company’s growth, competitive market landscape, customer loyalty, etc.

Unlike industry-agnostic SaaS or call center types of services, healthcare tech and tech-enabled services are extremely vertically integrated. At the current stage, it is the lack of scalable distribution channels, the challenging unit economics, and the slow pace of consumer adoption that the young sector needs to tackle moving forward.

The end of a hype cycle is a fresh beginning

Digital health has come a long way, and its definition has changed over time. Some may narrow it only to digital solutions that are patient and provider-centric. Others may elect to include insurance, pharma, and IT-related health products.

Over the last decade, we have seen many successes and failures. Some built competitive technologies that could change patients’ lives yet failed to find a market. Others created products that may not fit user behaviors such as the dozens of stand-alone AI chatbots for mental health in the mid-to-late 2010s or the coaching apps/services that have popped up in the past few years.

It is often more than simply the team’s execution. Digital healthcare products have a comparatively longer innovation cycle and sales cycle than average software products. Applications often need to prove both the scientific and economic benefits, like pharma and medical devices, which take longer to convince payors and distribution partners. Especially in the early days, it’s not uncommon to see a startup raise multiple seed fundings before meeting the so-called product-market fit. (Marc Andreesen defines PMF as crazy customer inbounds at the Series A stage. I rarely, if ever, have seen that in digital health before COVID.)

What’s important is that the failed companies have taught us a critical lesson in healthcare thinking – the complex incentives in our healthcare system to commercialize a digital healthcare product. Unlike medical devices or drugs with a commercialization playbook developed throughout the last century, digital healthcare founders must spend a lot of effort on standardizing innovations at an operational level. They run clinical and economic studies, price their products, ensure patient and stakeholder engagements, deal with regulatory bodies, assemble teams tailored to the applications, educate investors, and more.

The waves of innovation showed us what works and what does not and where innovative applications are in the technology hype cycle. Yet, the cycle maturity doesn’t directly translate to monetization. Healthcare is a service industry by nature. Patients expect more than the recommended action items and often want to know more about the disease causes and elaborate on their intuitions. That said, companies that provide a mix of technology and services for enhanced communications are rewarded with better user experiences.

I sincerely believe that every digital health company is a service company to a certain degree. For example, our portfolio company, Circadia, builds an RPM solution that passively monitors the patients. Beyond the traditional DaaS/SaaS model, the team hires dedicated nurses to triage the vital sign data. This service bundle not only ensures a much-improved patient engagement but also helps ease the care team's clinical burdens.

Undoubtedly, Covid-19 has been a catalyst to accelerate digital healthcare adoption across the board. The pandemic has reshaped how stakeholders engage patients and further incentivized them to prioritize specific digital solutions and stay competitive. Although there has been an ongoing debate regarding the sustainability of the emerging business models in healthcare, I am confident that telehealth and the ecosystem built around it will continue to prove their economic and societal benefits.

Meanwhile, not all digital health practices have benefited equally from Covid; using clinical trials as an example, specialty cares that require out-patient services were down (+50%) due to Covid’s rapid transmissibility. The pullback of new trial launches and ongoing recruitment hurt big pharma and medical device corporations and, if not more, the digital health startups with limited resources.

It also explains why remote trial startups have raked in billions of dollars in funding over the past two years. The benefit of clinical trial-enabled applications goes beyond simply augmenting the existing workflow. More importantly, it increases therapeutic development productivity by providing better reaches outside traditional research. Beyond logistics, the digital transformation has changed the status quo from trial administration & design to patient monitoring.

Another portfolio company of ours, Virgo, fills in the recruitment operation gaps by combining AI and the world's most extensive endoscopy video database to help pharma companies to identify and recruit patients into existing clinical trials starting with IBD. Before Virgo, over 90% of the endoscopy videos were not stored, and now, these recordings have become a critical piece of the trial screening process.

Since the pandemic, consumers emerged as a new monetization pathway to virtual care besides the traditional insurance and pharma plays, yet DTC has always been a tricky business across all industries. Increased customer acquisition costs, low barrier to entry, and LTV pressures have become persistent challenges for many healthcare companies.

While we are assessing the suitability of DTC as a stand-alone business model, the learning should be that the “new” distribution channels have proved a shift in consumer healthcare decision-making and how stakeholders adapt to that trend. Consumerization of healthcare is beyond paying out of pocket but more so about how consumers interact with the healthcare system from acquisition to re-engagement perspectives.

The B2C2B model is not new and has been proven effective in many SaaS applications, e.g., Slack, Superhuman, Notion, etc. Although we are still in the early development of consumer upsell in healthcare, the evolving trend will create new opportunities for the next-generation care delivery models. This will also improve the awkward situations faced by startups in the past decade such as ultra-long sales cycles or death by the pilot.

Now is the best time.

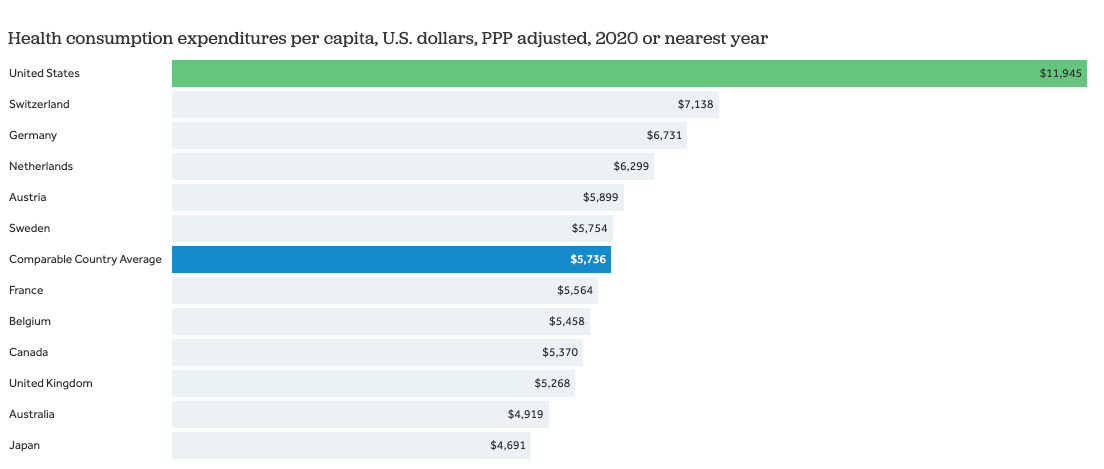

The benefit of the digital transformation of healthcare is worldwide but particularly felt in the U.S, where spending per capita is 2x the average of developed countries and physician per capita ranks 35th worldwide. Healthcare accounts for nearly 20% of the nation’s GDP ($4Tn), with less than 5% of it going towards digital transformation.

There still are many unmet needs in this slow-moving sector: an increased HCP shortage, opaque pricings, reimbursement operation hustles, and many more. And as an investor, we build an investment thesis by slicing the market in various ways such as target patient demographic, disease categories, business model types, and technology potentials. Investment opportunities, often, fit into multiple categories.

The two trends I am particularly excited about are healthcare 4.0 and labor redefined. Healthcare 4.0 goes beyond collecting and interpreting data. It focuses on how practical data-centric applications are to boost the efficiency of standard industry practices. It’s much easier said than done, given the limited healthcare resources available.

Previously, entrepreneurs took hard lessons on designing products to fit multi-stakeholder incentives. As the parties who pay are often not those who distribute or use the products, the newest cohort of founders now incorporate such teachings to reduce product development cycles.

Whether companies add the triage piece to improve remote patient monitoring value proposition or use in-house specialists to filter drug trial candidates, the trend is leaning toward using the “assembly-line” model to deliver healthcare services and automate each faction within the existing workflow. Now we have AI to help nurses and clinical staff reduce time spent doing administration-related tasks. Physicians like pathologists no longer spend hours reading slides through microscopes. Solo and small group practitioners can now better manage revenue cycles with robust reimbursement collections. These innovations can push the productivity boundary further while increasing resource utilization.

Healthcare was once a leading gig economy a half-century ago. Yet numerous factors have contributed to the consolidation of healthcare, raising the barrier to start a practice due to the higher financial and operational burdens. Those factors include but are not limited to new care models derived from government policy, private equity entering the market, and work-life balance consideration. This has resulted in a 30-year decline in physician entrepreneurs by +50%.

The decades of organizational consolidation haven’t fundamentally addressed the productivity restraints, and workers still experience extreme burnout due to increased administration needs and a labor shortage. Meanwhile, the virtual care model showed how telehealth and software automation could provide worker flexibility and improve financial compensation through side hustles. Virtual care workers' wages have improved nearly twofold in the past few years, with physicians and NP’s sometimes managing multiple contracts simultaneously.

It explains why hundreds of millions of dollars have gone into startups to capitalize on this trend like Nomad, Tebra, and Wheel. And we will continue to see more innovations around gig workers and independent practices, which provide 360-degree services to help them manage their daily practice in the era of telehealth.

The consensus is that we will likely see further industry consolidation in healthcare, especially post-Covid. However, will a concentrated labor market compensate HCPs more? Will more policies, e.g., direct primary care, incentivize people to start independent practices? How can digital solutions lower the barrier to entry onward? We would want to further testify the possibilities in the future.

Digital health has come through a couple of cycles from the mid-2010s, with innovators seeking to apply cutting-edge technologies such as AI, VR, and blockchain to the clinical world. And most recently, the world has witnessed an accelerated adoption of virtual care during the peak of the COVID-19 pandemic. The current market downturn will test our ecosystem while encouraging operators and investors to strengthen proven business models, refine unit economics, and justify proper valuation matrices.

Stay tuned,

Qi